Avoid Guarantors' Surrender in "Borrow Loans to Pay the Old"

Source: Beijing DOCVIT Law Firm Time: 2021-06-07 21:29:26 Author: The dispute resolution team

Foreword: According to the China Financial Non-performing Assets Market Survey Report (2021) issued by China Oriental Asset Management Co., Ltd. on April 16, 2021, the scale of non-performing loans of commercial banks will continue to increase, the non-performing rate will increase and the difficulty of disposal will be increased in 2021, and the disposal of non-performing assets will become more urgent. In the past, commercial banks have made a lot of "borrowing new and old" business to meet the needs of the production and operation of loan enterprises and reducing their non-performing loan rate. In fact, the non-performing loan rate has been treated as "technical treatment" from the account. In essence, the behavior leads to the indefinite extension of the loan term and the increasing risk of non-performing loans. Nowadays, a large number of non-performing assets disposal is imminent. How to avoid the guarantor's "out of guarantee" in "borrowing new loan to pay old loan" is not only an important grasp of the realization of the creditor's rights at the disposal end of the non-performing assets, but also determines the price of the non-performing asset package transferred by commercial banks.

This paper, based on the relevant laws and regulations such as the Civil Code of People's Republic of China (hereinafter referred to as "Civil Code"), studies the legal effect of the guarantor's "out of guarantee" and avoids the practice of "out of guarantee", so as to provide reference for the practitioners of commercial banks and asset management companies.

Ⅰ. An overview of "borrowing the new loan to pay the old loan" and its legal provisions

(1) The concept and characteristics of "borrowing the new loan to return the old loan"

Borrowing the new loan to pay the old loan is to use the new loan to pay the old loan, which usually occurs when the commercial bank can not recover the loan on time. It is a legal act that pays part or all of the old loan by issuing new loan again, so that the original loan is destroyed and a new legal relationship of loan is generated.

In the Reply of the People's Bank of China On Legal Issues Related To Loan Contracts ([1997] No. 320), it is mentioned that: "Paying the loan with loan (or paying the old loan with new loan) refers to the behavior of the borrower to make a loan from the bank to pay the loan previously owed to the same bank. The new loan contract is only a change to the terms of the original loan contract, such as the term of the loan."

In the Civil Second Court Final Trail(2008) No.81 case, the Supreme People's court also held the opinion that: "There is an essential difference between paying the old with new loans and paying the old with the lender's own funds, so as to eliminate the original creditor's rights and debts. Although the new loan replaces the old loan, the relationship between creditor's rights and debt between the lender and the borrower has not been eliminated. Objectively, it only extends the payment period of the old loan in the form of new loan, so the new loan is essentially a special extension of the old loan."

The Notice of the China Banking Regulatory Commission on the Current Adjustment of Some Credit Supervision Policies To Promote the Sound Development of the Economy (hereinafter referred to as the "notice") clearly stipulates that "project loans shall not be borrowed to new loan and old loan". The notice was issued in 2009 and abolished in 2014, even if it has not been abolished, according to the Supreme People's court's viewpoint in (2017) Supreme Court Civil Case No.675. The "notice" is a regulation of the CBRC on the internal management bank of the banking industry. Violation of the "notice" will not lead to the invalidity of loan contracts, guarantee contracts and other related contracts.

Therefore, from the legal documents mentioned above, we can see that the main features of paying the old by borrowing the new include the following six points:

①The loan is not payable at maturity;

②The original debtor is the same as the new debtor;

③Sign a new loan contract;

④The purpose of new loan is to pay old loan with new loan;

⑤The original loan still exists;

⑥The legal effect is subject to the contract law or civil code and other relevant laws.

(2) "Typical case of borrowing new loan to pay old loan" and "atypical case of borrowing new loan to pay old loan"

Through a large number of case retrieval, we can roughly divide borrowing new loan for old loan into "typical case of borrowing new loan to pay old loan" and "atypical case of borrowing new loan to pay old loan".

2.1 A typical way to pay the old loan by borrowing the new loan

2.1.1 "Typical case of borrowing the new loan to pay the old loan" type one: new loan pays old loan directly, that is, the bank and the borrower clearly agree that the content of the loan contract is new loan for old loan.

For example: the Supreme People's court held in the (2017) Supreme People's Court Civil Case No. 676 financial loan contract dispute case: "In this case, the cases signed by Meisheng company involved the maximum amount mortgage contract and the maximum amount guarantee contract, which clearly agreed that the loans could be used to pay the old loans by borrowing."

2.1.2 Type two of "typical case of borrowing the new loan to pay the old loan": the entities of the new and old loans are the same, the time is continuous, and the loan amount is similar, that is, the contract terms do not explicitly stipulate "borrowing the new loan to pay the old loan", but the fact that the borrower conceals "borrowing the new loan to pay the old loan" by revolving the loan between multiple entities and accounts will also be recognized as "borrowing the new loan to pay the old loan".

2.2 Atypical case of borrowing the new loan to pay the old loan

2.2.1 Type one of "atypical case of borrowing the new loan to pay the old loan": when borrowing new loan for paying old loan through a third party, whether the third party is used to borrow or pay or not, as long as the new loan is used to pay the old loan, it may be identified as "borrowing new loan to pay the old loan".

2.2.2 Type two of "atypical case of borrowing the new loan to pay the old loan": Although there is behavior of loaning, the loan fund is not actually transferred. Instead, issuing receipts as "new loan is directly deducted when the old loan is due" or "new loan is directly transferred" or "the new loan is used to pay" and other acts to assume the fund is actually lent, such acts may be regarded as "borrowing the new loan to pay the old loan".

2.3 The defining principle of "typical case of borrowing the new loan to pay the old loan" and "atypical case of borrowing the new loan to pay the old loan"

According to the spirit of the minutes of the National Civil and Commercial Trial Work Conference, the people's court requires judges to find out the true meaning of the parties and explore the true legal relationship through penetrating trial thinking. Therefore, whether it is "typical case of borrowing new loan to pay the old loan" or "atypical case of borrowing new loan to pay the old loan", the judicial practice will be carried out in a "penetrating" way. In the process of trial, the facts of the case and the legal relationship will be identified in combination with the true intention of the parties and the connotation and essence of the case facts. However, various "innovative" models are emerging one after another to cover up the "borrowing new loan to pay the old loan". How to actively deal with the "borrowing new loan to pay the old loan" business from the perspective of law and practice and avoid the guarantor's "out of guarantee" in the "borrowing new loan to pay the old loan" is of great significance to the non-performing assets clearing business of commercial banks and asset management companies.

Ⅱ. The comparison of the legal effect of the guarantor in "borrowing new loan to pay the old loan" before and after the Civil Code comes into effect

(1) Before the Civil Code comes into effect

Before the Civil Code came into effect, the legal effect of "borrowing new loan to pay the old loan" was restricted by the guarantee law and the judicial interpretation of the guarantee law.

Article 39 of the judicial interpretation of the Guarantee Law stipulates: "If the parties to the main contract agree to pay the old loan with the new loan, the guarantor shall not bear civil liability except for those that the guarantor knows or should know. If the new loan and the old loan are the same guarantor, the provisions of the preceding paragraph shall not apply.

(2) After the Civil Code comes into effect

After the Civil Code comes into effect, the legal effect of "borrowing new loan to pay the old loan" is subject to the relevant provisions of the Civil Code and the interpretation of the guarantee system of the Civil Code.

Article 16 of the Interpretation of the Guarantee System of the Civil Code stipulates: "If the parties to the main contract agree to pay the old loan with the new loan, and the creditor requests the guarantor of the old loan to undertake the guarantee liability, the people's court will not support it; If the creditor requests the guarantor of the new loan to assume the guarantee liability, it shall be handled in accordance with the following circumstances:

① If the guarantor of the new loan is the same as that of the old loan, the people's court shall support it;

② If the guarantor of the new loan is different from that of the old loan, or the old loan is not guaranteed, and the new loan is guaranteed, the people's court will not support it, except for the creditor who has evidence to prove that the guarantor of the new loan knows or should know the fact of paying the old loan with the new loan.

If the parties to the main contract agree to pay the old loan with the new loan, and the guarantor of the old loan agrees to continue to provide security for the new loan even though the registration has not yet been cancelled, and before the conclusion of the new loan contract, the people's court will not support it if other creditors claim that the priority of the security interest is given to the new creditor."

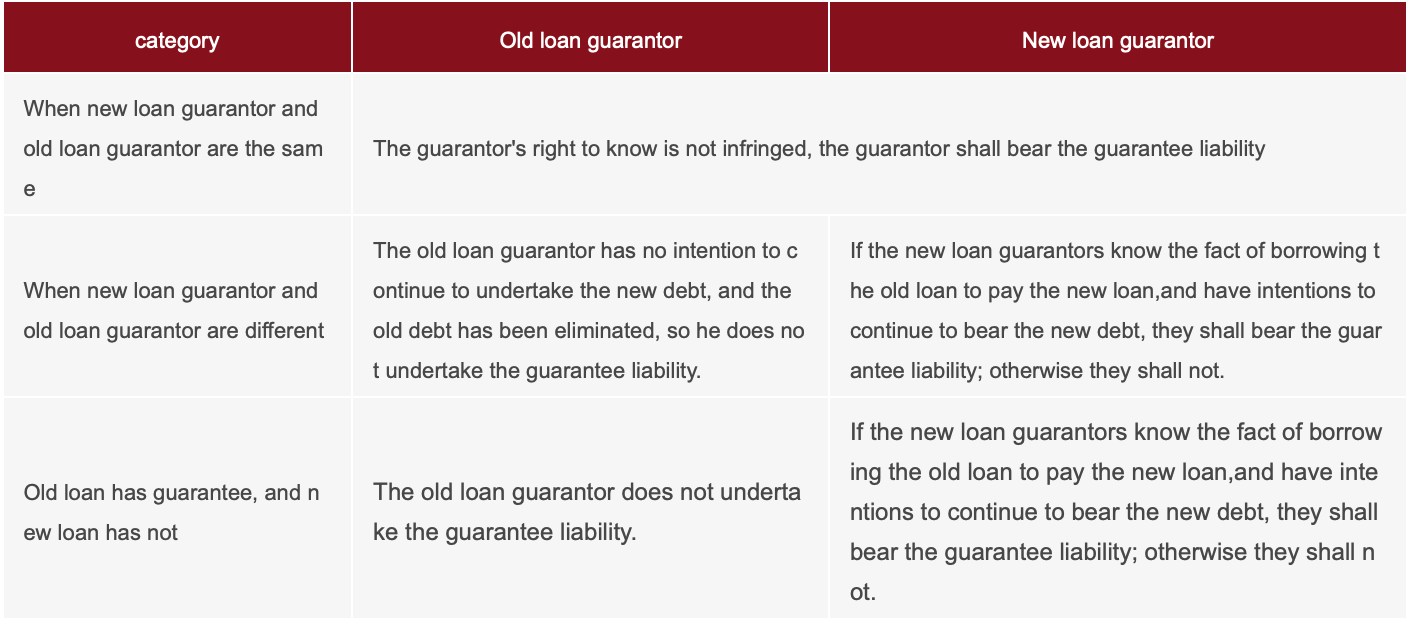

(3) A comparative study on the legal effect of "borrowing new loan to pay the old loan" guarantors before and after the Civil Code comes into effect

Article 16 of the Interpretation of the Guarantee System of the Civil Code is essentially an inheritance and refinement on the basis of Article 39 of the Judicial Interpretation of the Guarantee Law, which can be concluded as the following:

Ⅲ. Risk control suggestions of "borrowing new loan to pay the old loan" to prevent "out of guarantee"

(1) Require the old loan guarantor to continue to bear the responsibility with written consent in "borrowing new loan to pay the old loan"

According to the distribution of burden of proof of "borrowing new loan to pay the old loan", commercial banks and asset management companies shall prove that the fact that "borrowing new loan to pay the old loan" to the guarantor is the case that the guarantor knows or should know that the loan is still providing the guarantee, or it should bear the adverse consequences of proof, that is, the guarantor shall not bear the guarantee liability. Therefore, in the process of "borrowing new loan to pay the old loan" business, the old loan guarantor should be required to issue a written commitment or guarantee letter to continue to be responsible, and make clear the facts of the new and new loans and the guarantor's willingness to guarantee.

(2) The general agreement clauses in the old loan contract and guarantee contract can not be "once and for all", and a new guarantee contract should be signed

When commercial banks and asset management companies sign the loan contract, guarantee contract and other transaction documents (old loan) with borrowers, they usually agree in advance to change the main contract without the consent of the guarantor. However, in practice, such agreement can not be inferred as the guarantor's knowledge and consent of "borrowing new loan to pay the old loan"; Especially after the civil code comes into effect, the aggravation of the obligation of presentation in standard terms makes the effect of the general consent clause more severe. Therefore, in the business of "borrowing new loan to pay the old loan", even if the loan contract and guarantee contract of the old loan agree that there is no need for the guarantor's consent, a new guarantee contract should be signed to avoid "out of guarantee".

(3) Strictly review the purpose of borrowing to avoid the change of purpose being "out of guarantee"

Loan contract and guarantee contract have mandatory binding force on commercial banks and asset management companies, which are also the fundamental basis for commercial banks and asset management companies to claim rights. The guarantor makes guarantee based on the contents of "loan contract", and the commercial banks or asset management companies indulge and acquiesce in the borrower's misappropriation, If it is beyond the scope that the guarantor can reasonably foresee, the guarantor has the right not to undertake the guarantee liability accordingly. Therefore, commercial banks should strictly abide by the agreement on the purpose of the loan in the loan contract, should not indulge in the change of the purpose of the loan, and should stop the change of the purpose of the loan in time.

(4) It is not allowed to use the loan for "borrowing new loan to pay the old loan" with the borrower without the permission from the guarantor

No matter guarantee or mortgage guarantee, the borrower and the bank's unauthorized change of loan use will change the guarantor's expectation of guarantee risk when providing guarantee, and increase its guarantee liability. If the guarantor does not know, he can be exempted from the guarantee liability.

(5) The guarantor shall be informed of the fact of "borrowing the new loan to pay the old loan" by using the relevant notice or other written documents

To inform the guarantor of the fact of "borrowing the new loan to pay the old loan" with the "notice letter" or other written documents can avoid the bank's unfavorable proof.

Ⅳ. Conclusion

According to the distribution rules of burden of proof in the Civil Procedure Law, commercial banks or asset management companies should bear the burden of proof for the fact that the guarantor knows or should know that the loan is used to pay the old loan. In most cases of financial loan contract disputes, the main reason why banks lose lies in the failure to prove that the guarantor knows that the loan is used to pay the old loan. Therefore, in order to avoid the "out of guarantee" event, commercial banks or asset management companies should strengthen risk control management and daily business management, and strive to strictly review the use of loans, strengthen and clarify the obligation to inform the guarantor, the obligation to disclose all kinds of contracts and commitments, and the evidence traces of e-mail / wechat and audio and video recording, so as to prevent the occurrence.

May be interested

Professional Team

- A

- B

- C

- D

- E

- F

- G

- H

- I

- J

- K

- L

- M

- N

- O

- P

- Q

- R

- S

- T

- U

- V

- W

- X

- Y

- Z

Series Product Line

MoreIndustry Research

More-

Legal Health Index Report on National Insurance Industry (2015 - 2017)Legal Health Index Report on National Insurance Industry (2015 - 2017) is compiled by Green Legal Global Alliance (GLGA), with the Beijing Docvit Law Firm as the professional support unit. Under the guidance of an external team of experts, it is one of the series of research topics in the legal health index report of capital market industry. In 2017, Green Legal Global Alliance (GLGA) successfully released its first research achievement of the series of research projects in the legal health index report on capital market industry, that is the Legal Health Index Report on Private Equity Industry. Report on Insurance Industry Legal Health Index is the second research result of this research topic. -

2018 Blue Book of Legal Health of China's Insurance Industry2018 Blue Book of Legal Health of China's Insurance Industry includes Part I Legal Health Index Report on Insurance Industry and Part II Special Legal Report on Insurance Industry. Among which, the Legal Health Index Report on Insurance Industry is the second report issued by Green Legal Global Alliance (GLGA) after it successfully issued the first Legal Health Index Report on Insurance Industry in 2018. The index can comprehensively and intuitively reflect the overall legal health status of the insurance industry in the past three years. -

Legal Health Index Report on National Private Equity IndustryThe purpose of this report is to provide insights into legislation, regulation, and justice in the form of private equity industry indices. As the first legal cross-border alliance which takes the law as the core element, research institute as the support, the Internet as the platform, and the internationalization as the vision, Green Legal Global Alliance (GLGA) has been concerned about the ways in which legislation, regulation and justice will affect the private placement industry. Up to now, the volume of private equity funds has grown to the same level as public funds, and its development speed is so rapid.

News

MoreNews | DOCVIT Law Firm Successfully Held the 2026 Strategy and Management Conference at Its Beijing HeadquartersNew Year Address From Chief Partner Guangchao Liu | Forge Ahead with Resolve, Chasing Dreams On New JourneyDocvit News | Mr. XI Xiaohong, senior adviser of our firm, was invited to attend "CBLJ Forum 2019" and delivered a wonderful speechDocvit News | Director LIU Guangchao was employed as the instructor of the 11th "Sunshine Growth Program for Young Lawyers" of Beijing Lawyers Association

Performance

MoreAchievements of Docvit | We managed to win the bid for the legal service institutional repository of China National Nuclear CorporationAchievements of Docvit | We managed to win the bidding for the alternative repository of legal services intermediary institution of China Petroleum & Chemical Sales Co., Ltd. Shanxi BranchAchievements of Docvit | We managed to enter into contracts with several institutions and would provide regular legal services for them.Achievements of Docvit | We managed to get shortlisted in the external non-litigious lawyer repository of China Chengtong Holdings Group Ltd.

Fellow Program

More-

【Fellow Program I】

With the launch of the "Fellow Program", Docvit hopes to unite with the like-minded lawyers of the country to build a career platform and realize their career dreams together. "Fellow Program I" aims to recruit partners, business partners and executive directors for the Docvit Branch in China. -

【Fellow Program II】

"Fellow Program II" aims to recruit partners and lawyers for Docvit Headquarters and Beijing Office across the country and around the world to become what the industry, Docvit itself, market and clients want. -

【Fellow Program III】

"Fellow Program III" aims to recruit partners for national branches of Docvit nationwide and globally. Docvit's national and global development blueprints require more partners to draw together, and let us work together to create a respectable law firm.

Brand Activity

More-

[08/31]Forum on Insurance & Insurance Asset Management Industries’ Innovation and Legal Health Development under the New Pattern of Financial Opening-up and Release Conference of Blue Book of Legal Health of China’s Insurance Industry 2018 (Index & Special Reports)

At present, China’s financial open-up has entered a substantial promotion stage, and as an important link thereof, opening-up of insurance industry plays a unique role in financial opening-up. Under the new opening-up pattern of finance and insurance industry, and in the new situation of pan-asset management and integrated development, it has become an urgent topic to discuss and study how China’s insurance asset management institutions should grasp development opportunities, meet challenges head on, how to promote standardized transformation and sound development of the insurance and insurance asset management industries, and how to achieve innovation and high-quality development in compliance. -

[08/17]Launch ceremony of DOCVIT bond default dispute resolution new product line and seminar on bond default disposal and bond market development under the new normal of economy

Halfway through 2019, how will the bond market perform in the second half of the year? How will various factors affecting the bond market work? Where are the investment opportunities? How do bond default disposal and bond market develop under the new normal of economy? In order to discuss the above issues in depth, Beijing DOCVIT Law Firm will hold a seminar “bond default disposal and bond market development under the new normal of economy”. At the seminar, DOCVIT bond default dispute resolution new product line will be released; the product line studies and analyzes the development environment of China’s bond market and the problems and challenges facing its dispute resolution in the context of the new normal of economy and, from a legal perspective, explores the new ideas on bond default disposal in the context of tighter regulation. -

[08/03]3rd Forum on China’s Economic Development and Legal Regulation and Release Ceremony of GLGA Blue Book of China’s Non-performing Assets 2018

In recent years, in the face of a complex international environment and arduous tasks of domestic reform, development and stability, China's economy has maintained a generally steady development trend. However, the Sino-US trade issue is still unresolved and, given the aftershocks of domestic market’s breaking the rigid payment, can China’s economy maintain low volatility and high-quality, stable development in the future? And what opportunities and challenges will China’s macroeconomic development face?